Betashares NZ Sustainability Leaders Fund

- Australasian shares

Invest in a portfolio of sustainable, ethical New Zealand companies

Overview

Fund objective

The fund aims to track the performance of an index (before fees and expenses) that includes companies headquartered in New Zealand, and listed on either the New Zealand Stock Exchange (NZX) or the Australian Securities Exchange (ASX), that have passed screens to exclude companies with direct or significant exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations (subject to certain materiality thresholds).

The fund’s methodology also increases allocation to companies classified as ‘Sustainability Leaders’. The criteria for classification as a Sustainability Leader are determined with reference to the United Nations Sustainable Development Goals.

Benefits

-

Align your investments with your values

Invest in a way that is consistent with your ethical standards. The Fund’s strict screening criteria ensure that it remains ‘true to label,’ providing investors with access to companies engaged in sustainable and ethical business practices.

-

Capture the economic footprint of Kiwi companies across both NZX and ASX

Access ethical NZ companies listed both domestically and in Australia. NZ companies listed on the ASX and currently in the index include Xero for example, one of NZ’s most valuable publicly listed companies.1

-

Diversified exposure

Gain exposure to a diversified portfolio of ethical New Zealand companies contributing to long-term social and environmental well-being.

1 As at 5 November 2024. No assurance is given that any of the companies in fund’s portfolio will remain in the portfolio or will be profitable investments.

There are risks associated with an investment in the Fund including market risk and non-traditional index methodology risk. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the SIPO, PDS and OMI available on this website.

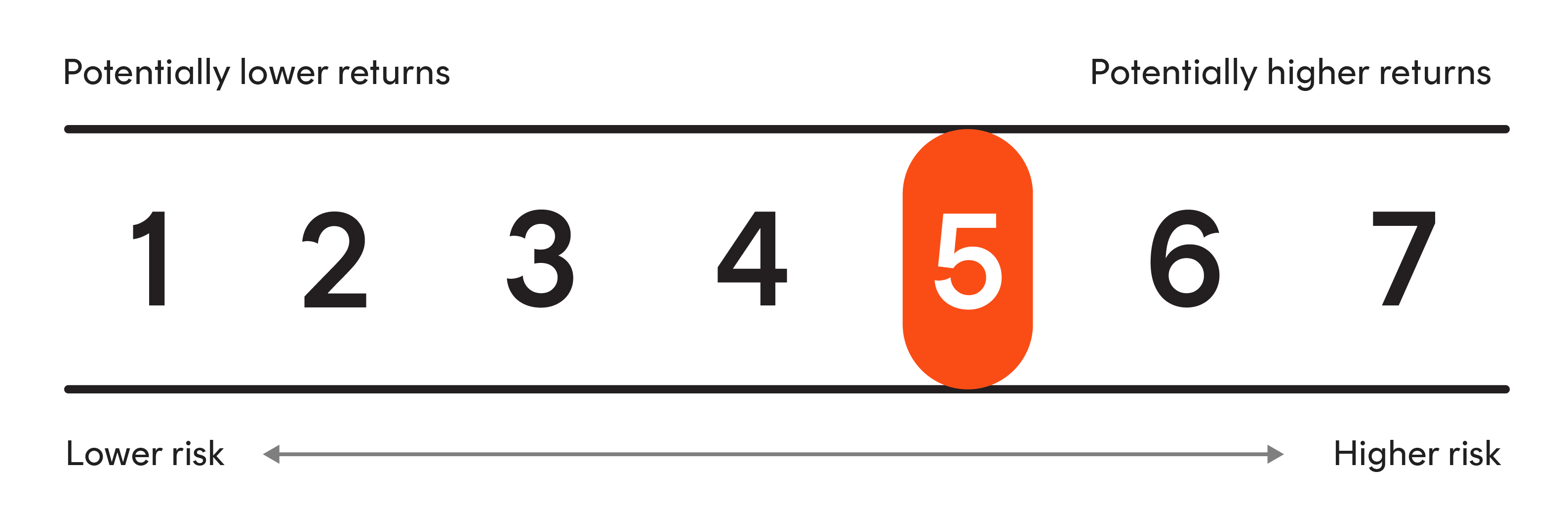

Risk indicator

The Fund is expected to have a high level of volatility. See the PDS for more information regarding the risk indicator.

How to invest

- You can invest in Betashares NZ funds through an approved platform

- Contact us to enquire about direct applications (minimum investment $500,000)

Key facts

Profile

| Net assets ($NZ) | |

|---|---|

| Annual Fund Charges | 0.59% |

| Buy/Sell spread | 0.05% |

| Distribution frequency | N/A |

| Distribution reinvestment plan (DRP) | N/A |

**Certain additional costs apply. Please refer to PDS.

Index information

| Index | Solactive New Zealand Sustainable Leaders Index |

|---|---|

| Index provider | Solactive AG |

| Index ticker | SOLNZSLN |

| Bloomberg index ticker | SOLNZSLN Index |

Holdings & allocation

Portfolio exposure

| Name | Weight (%) |

|---|---|

| XERO LTD | 10.6% |

| FISHER & PAYKEL HEALTHCARE COR | 10.1% |

| INFRATIL LTD | 9.2% |

| AUCKLAND INTERNATIONAL AIRPORT | 8.7% |

| MERIDIAN ENERGY LTD | 8.0% |

| SPARK NEW ZEALAND LTD | 5.7% |

| MAINFREIGHT LTD | 5.3% |

| EBOS GROUP LTD | 5.1% |

| MERCURY NZ LTD | 4.8% |

| A2 MILK CO LTD/THE | 3.8% |

* As at 5 November 2024.

Index sector exposure

| Health Care | 21.2% |

|---|---|

| Industrials | 20.8% |

| Utilities | 12.8% |

| Information Technology | 12.3% |

| Financials | 10.2% |

| Communication Services | 8.9% |

| Real Estate | 8.7% |

| Consumer Staples | 4.2% |

| Consumer Discretionary | 0.6% |

| Materials | 0.3% |

* As of 31 October 2024

Performance

Fund returns after fees (%)

| Fund | Index | |

|---|---|---|

| 1 month | - | 1.27% |

| 3 months | - | 1.59% |

| 6 months | - | 6.60% |

| 1 year | - | 18.27% |

| 3 year p.a. | - | -0.72% |

| 5 year p.a. | - | - |

| 10 year p.a. | - | - |

| Since inception (p.a.) | - | - |

| Inception date | - | 20-Mar-20 |

* As at 31 October 2024.

Past performance is not an indicator of future performance. Returns are calculated in New Zealand dollars using exit unit prices at the start and end of the specified period. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. Returns for periods longer than one year are annualised. Current performance may be higher or lower than the performance shown.