Betashares Global Sustainability Leaders Fund

- Ethical & Responsible

- International shares

Invest in a portfolio of ethically-screened global securities

Overview

Fund objective

The Fund aims to track the performance of an index (before fees and expenses) that includes a portfolio of large global stocks identified as ‘Climate Leaders’ that have also passed screens to exclude companies with direct or significant exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations.

Benefits

-

Align your investments with your values

Invest in a way that is consistent with your ethical standards.

-

True-to-label

The Fund combines positive climate leadership screens with a broad set of ESG-criteria, offering investors a true-to-label ethical investment solution.

-

Diversified global exposure

The Fund holds a diversified portfolio of large, sustainable, ethical companies from a range of global locations.

There are risks associated with an investment in the Fund, including market risk, international investment risk, non-traditional index methodology risk and foreign exchange risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement, SIPO and OMI available on this website.

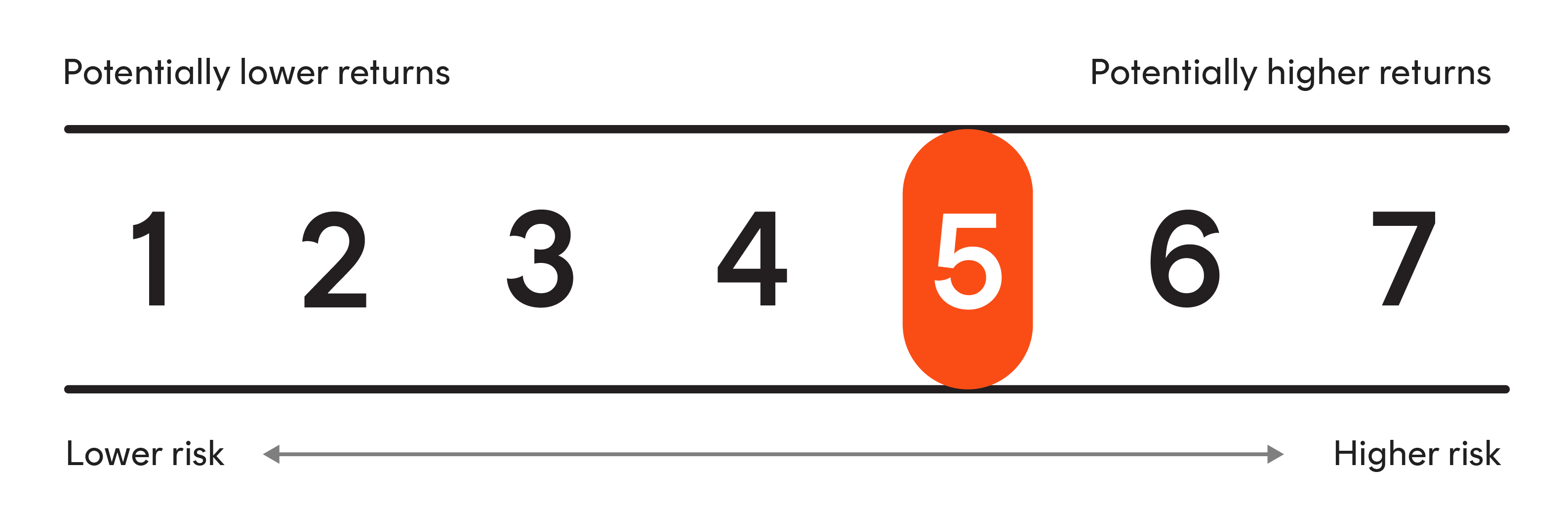

Risk indicator

The Fund is expected to have a very high level of volatility. See the PDS for more information regarding the risk indicator.

How to invest

- You can invest in Betashares NZ funds through an approved platform

- Contact us to enquire about direct applications (minimum investment ($500,000)

|

Key facts

Profile

| NAV / Unit | $1.5691 |

|---|---|

| Net assets ($NZ) | $118,469,119 |

| Annual Fund Charges | 0.77% |

| Buy/Sell spread | 0.15% |

| Distribution frequency | N/A |

| Distribution reinvestment plan (DRP) | N/A |

| Manager | Betashares Capital NZ Ltd |

| Registry | MUFG Corporate Markets |

| Supervisor | Trustees Executors Limited |

Index information

| Index | Nasdaq Future Global Sustainability Leaders Index |

|---|---|

| Index provider | Nasdaq |

| Index ticker | N/A |

| Bloomberg index ticker | NQFGSLN Index |

Holdings & allocation

Portfolio exposure

| Name | Weight (%) |

|---|---|

| BROADCOM INC | 6.9% |

| NVIDIA CORP | 5.9% |

| APPLE INC | 4.1% |

| HOME DEPOT INC/THE | 3.4% |

| MASTERCARD INC | 3.3% |

| VISA INC | 3.2% |

| TOYOTA MOTOR CORP | 3.1% |

| ASML HOLDING NV | 3.0% |

| APPLIED MATERIALS INC | 1.8% |

| ABBVIE INC | 1.5% |

* As at 5 March 2026.

As described in the PDS, the Fund may either invest directly and/or via an underlying exchange traded fund (ETF). The information above shows either the direct holdings of the Fund or the holdings of the underlying ETF on a look through basis which closely approximates the Fund’s percentage exposure to those investments.

Index sector exposure

| Information Technology | 36.2% |

|---|---|

| Financials | 23.5% |

| Consumer Discretionary | 14.1% |

| Health Care | 13.0% |

| Industrials | 6.5% |

| Real Estate | 3.3% |

| Communication Services | 2.7% |

| Materials | 0.4% |

| Utilities | 0.2% |

| Consumer Staples | 0.1% |

* As of 30 January 2026

Index country exposure

| United States | 73.4% |

|---|---|

| Japan | 7.7% |

| Netherlands | 3.9% |

| Canada | 2.6% |

| Germany | 2.3% |

| Britain | 1.9% |

| Switzerland | 1.8% |

| France | 1.5% |

| Denmark | 1.5% |

| Other | 3.5% |

* As of 30 January 2026

Performance

Fund returns after fees (%)

| Fund | Index | |

|---|---|---|

| 1 month | 0.25% | 0.30% |

| 3 months | -4.55% | -4.40% |

| 6 months | 1.26% | 1.58% |

| 1 year | 1.43% | 2.04% |

| 3 year p.a. | - | 17.07% |

| 5 year p.a. | - | 13.84% |

| 10 year p.a. | - | 15.91% |

| Since inception | 17.55% | 18.09% |

| Inception date | 16-May-23 | - |

* As at 27 February 2026.

Past performance is not an indicator of future performance. Returns are calculated in New Zealand dollars using exit unit prices at the start and end of the specified period. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. Returns for periods longer than one year are annualised. Current performance may be higher or lower than the performance shown.

Chart

Past performance is not indicative of future performance. Please refer to "Fund returns after fees" for additional information regarding performance/return information.