Betashares Australia 200 Fund

- Australian shares

Access a low-cost portfolio of Australia’s top 200 companies

Overview

Fund objective

The Fund aims to track the performance of an index (before fees and expenses) comprising the 200 largest companies by market capitalisation listed on the ASX.

Benefits

-

Low-cost investing

Gain low-cost access to the broad Australian share market, with annual fund charges of only 0.23% p.a. of net asset value (or $23 for every $10,000 invested).*

-

Portfolio diversification

Sector weightings of the Australian share market are very different to that of the NZ share market. The Fund offers portfolio diversification benefits to investors with existing exposure to the broad NZ share market.

-

Flexible exposure

The Fund can be used as your core allocation to Australian shares, or to gain tactical exposure to Australian equities.

*Other costs, such as transaction costs, may apply. Refer to the PDS for more information.

There are risks associated with an investment in the Fund, including market risk, security-specific risk, industry sector risk and index tracking risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement, SIPO and OMI, available on this website.

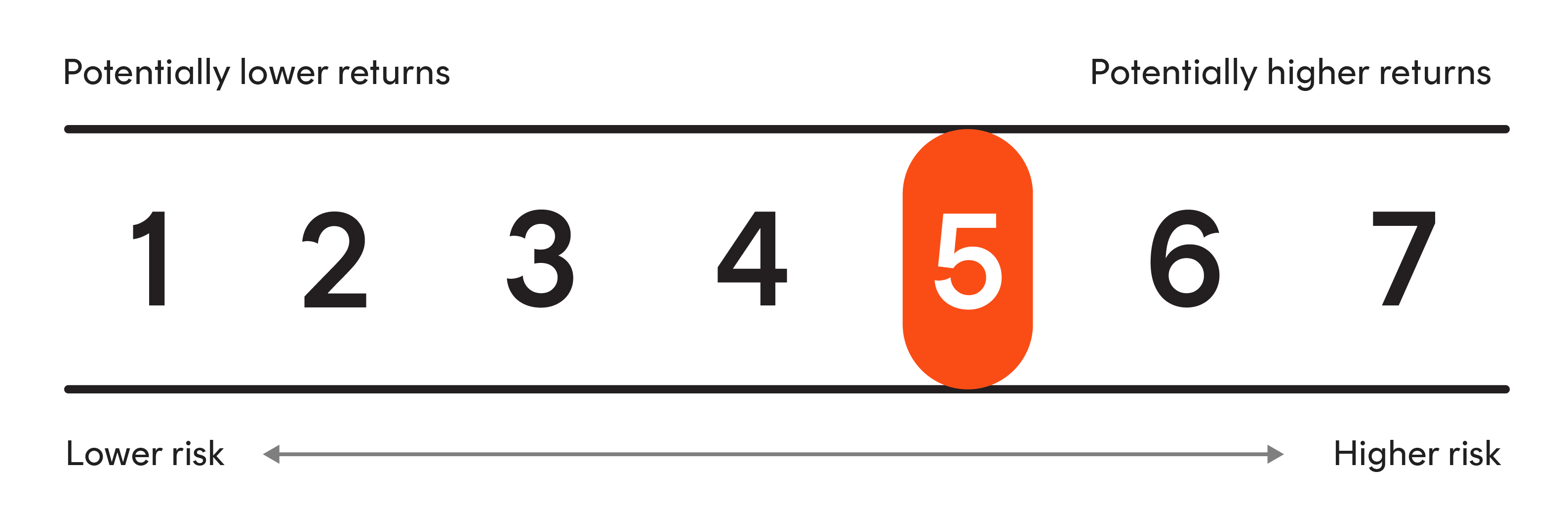

Risk indicator

The Fund is expected to have a very high level of volatility. See the PDS for more information regarding the risk indicator.

How to invest

- You can invest in Betashares NZ funds through an approved platform

- Contact us to enquire about direct applications (minimum investment $500,000)

Key facts

Profile

| NAV / Unit | $1.5676 |

|---|---|

| Net assets ($NZ) | $51,054,402 |

| Annual Fund Charges | 0.23% |

| Buy/Sell spread | 0.03% |

| Distribution frequency | N/A |

| Distribution reinvestment plan (DRP) | N/A |

| Manager | Betashares Capital NZ Ltd |

| Registry | MUFG Corporate Markets |

| Supervisor | Trustees Executors Limited |

Index information

| Index | Solactive Australia 200 Index |

|---|---|

| Index provider | Solactive AG |

| Index ticker | N/A |

| Bloomberg index ticker | SOLAUBMG Index |

Holdings & allocation

Portfolio exposure

| Name | Weight (%) |

|---|---|

| COMMONWEALTH BANK OF AUSTRALIA | 10.5% |

| BHP GROUP LTD | 10.4% |

| NATIONAL AUSTRALIA BANK LTD | 5.3% |

| WESTPAC BANKING CORP | 5.2% |

| ANZ GROUP HOLDINGS LTD | 4.3% |

| WESFARMERS LTD | 3.3% |

| MACQUARIE GROUP LTD | 2.7% |

| CSL LTD | 2.6% |

| RIO TINTO LTD | 2.3% |

| TELSTRA GROUP LTD | 2.2% |

| Ticker | Name | Weight (%) |

|---|---|---|

| CBA AT | COMMONWEALTH BANK OF AUSTRALIA | 10.5% |

| BHP AT | BHP GROUP LTD | 10.4% |

| NAB AT | NATIONAL AUSTRALIA BANK LTD | 5.3% |

| WBC AT | WESTPAC BANKING CORP | 5.2% |

| ANZ AT | ANZ GROUP HOLDINGS LTD | 4.3% |

| WES AT | WESFARMERS LTD | 3.3% |

| MQG AT | MACQUARIE GROUP LTD | 2.7% |

| CSL AT | CSL LTD | 2.6% |

| RIO AT | RIO TINTO LTD | 2.3% |

| TLS AT | TELSTRA GROUP LTD | 2.2% |

| WDS AT | WOODSIDE ENERGY GROUP LTD | 2.1% |

| GMG AT | GOODMAN GROUP | 2.1% |

| TCL AT | TRANSURBAN GROUP | 1.7% |

| WOW AT | WOOLWORTHS GROUP LTD | 1.6% |

| NST AT | NORTHERN STAR RESOURCES LTD | 1.6% |

| EVN AT | EVOLUTION MINING LTD | 1.3% |

| BXB AT | BRAMBLES LTD | 1.2% |

| QBE AT | QBE INSURANCE GROUP LTD | 1.2% |

| FMG AT | FORTESCUE METALS GROUP LTD | 1.2% |

| COL AT | COLES GROUP LTD | 1.0% |

| ALL AT | ARISTOCRAT LEISURE LTD | 0.9% |

| STO AT | SANTOS LTD | 0.9% |

| S32 AT | SOUTH32 LTD | 0.8% |

| ORG AT | ORIGIN ENERGY LTD | 0.7% |

| RMD AT | RESMED INC | 0.7% |

| SCG AT | SCENTRE GROUP | 0.7% |

| NEM AT | NEWMONT CORP | 0.7% |

| LYC AT | LYNAS RARE EARTHS LTD | 0.7% |

| CPU AT | COMPUTERSHARE LTD | 0.6% |

| PLS AT | PILBARA MINERALS LTD | 0.6% |

| IAG AT | INSURANCE AUSTRALIA GROUP LTD | 0.6% |

| SUN AT | SUNCORP GROUP LTD | 0.6% |

| QAN AT | QANTAS AIRWAYS LTD | 0.5% |

| JHX AT | JAMES HARDIE INDUSTRIES PLC | 0.5% |

| XRO AT | XERO LTD | 0.5% |

| ALQ AT | ALS LTD | 0.5% |

| SIG AT | SIGMA HEALTHCARE LTD | 0.4% |

| APA AT | APA GROUP | 0.4% |

| MPL AT | MEDIBANK PVT LTD | 0.4% |

| TLC AT | LOTTERY CORP LTD/THE | 0.4% |

| SGP AT | STOCKLAND | 0.4% |

| BSL AT | BLUESCOPE STEEL LTD | 0.4% |

| COH AT | COCHLEAR LTD | 0.4% |

| ORI AT | ORICA LTD | 0.4% |

| SHL AT | SONIC HEALTHCARE LTD | 0.4% |

| ASX AT | ASX LTD | 0.4% |

| MIN AT | MINERAL RESOURCES LTD | 0.4% |

| CHC AT | CHARTER HALL GROUP | 0.4% |

| GPT AT | GPT GROUP/THE | 0.4% |

| VCX AT | VICINITY LTD | 0.3% |

| SFR AT | SANDFIRE RESOURCES LTD | 0.3% |

| SOL AT | WASHINGTON H SOUL PATTINSON & | 0.3% |

| SGH AT | SGH LTD | 0.3% |

| RMS AT | RAMELIUS RESOURCES LTD | 0.3% |

| JBH AT | JB HI-FI LTD | 0.3% |

| AMC AT | AMCOR PLC | 0.3% |

| WTC AT | WISETECH GLOBAL LTD | 0.3% |

| CAR AT | CARSALES.COM LTD | 0.3% |

| NXT AT | NEXTDC LTD | 0.3% |

| PRU AT | PERSEUS MINING LTD | 0.3% |

| QUB AT | QUBE HOLDINGS LTD | 0.3% |

| MGR AT | MIRVAC GROUP | 0.3% |

| GMD AT | GENESIS MINERALS LTD | 0.3% |

| RHC AT | RAMSAY HEALTH CARE LTD | 0.3% |

| HUB AT | HUB24 LTD | 0.3% |

| WGX AT | WESTGOLD RESOURCES LTD | 0.3% |

| REA AT | REA GROUP LTD | 0.3% |

| TNE AT | TECHNOLOGY ONE LTD | 0.3% |

| GGP AT | GREATLAND RESOURCES LTD | 0.3% |

| AZJ AT | AURIZON HOLDINGS LTD | 0.3% |

| DXS AT | DEXUS | 0.3% |

| RRL AT | REGIS RESOURCES LTD | 0.3% |

| ALD AT | AMPOL LTD | 0.3% |

| FPH AT | FISHER & PAYKEL HEALTHCARE COR | 0.2% |

| PME AT | PRO MEDICUS LTD | 0.2% |

| WHC AT | WHITEHAVEN COAL LTD | 0.2% |

| DNL AT | DYNO NOBEL LTD | 0.2% |

| EDV AT | ENDEAVOUR GROUP LTD/AUSTRALIA | 0.2% |

| VAU AT | VAULT MINERALS LTD | 0.2% |

| BEN AT | BENDIGO & ADELAIDE BANK LTD | 0.2% |

| PDN AT | PALADIN ENERGY LTD | 0.2% |

| CMM AT | CAPRICORN METALS LTD | 0.2% |

| AGL AT | AGL ENERGY LTD | 0.2% |

| CWY AT | CLEANAWAY WASTE MANAGEMENT LTD | 0.2% |

| IGO AT | IGO LTD | 0.2% |

| SEK AT | SEEK LTD | 0.2% |

| DOW AT | DOWNER EDI LTD | 0.2% |

| WOR AT | WORLEY LTD | 0.2% |

| A2M AT | A2 MILK CO LTD/THE | 0.2% |

| LNW AT | LIGHT & WONDER INC | 0.2% |

| VNT AT | VENTIA SERVICES GROUP PTY LTD | 0.2% |

| ALX AT | ATLAS ARTERIA LTD | 0.2% |

| ANN AT | ANSELL LTD | 0.2% |

| SDF AT | STEADFAST GROUP LTD | 0.2% |

| BOQ AT | BANK OF QUEENSLAND LTD | 0.2% |

| CGF AT | CHALLENGER LTD | 0.2% |

| AAI AT | ALCOA CORP | 0.2% |

| REH AT | REECE LTD | 0.1% |

| 360 AT | LIFE360 INC | 0.1% |

| CDA AT | CODAN LTD/AUSTRALIA | 0.1% |

| XYZ AT | BLOCK INC | 0.1% |

| APE AT | EAGERS AUTOMOTIVE LTD | 0.1% |

| EMR AT | EMERALD RESOURCES NL | 0.1% |

| TWE AT | TREASURY WINE ESTATES LTD | 0.1% |

| NSR AT | NATIONAL STORAGE REIT | 0.1% |

| SGM AT | SIMS LTD | 0.1% |

| MTS AT | METCASH LTD | 0.1% |

| RSG AT | RESOLUTE MINING LTD | 0.1% |

| LTR AT | LIONTOWN RESOURCES LTD | 0.1% |

| DRO AT | DRONESHIELD LTD | 0.1% |

| NWL AT | NETWEALTH GROUP LTD | 0.1% |

| BRG AT | BREVILLE GROUP LTD | 0.1% |

| NHF AT | NIB HOLDINGS LTD/AUSTRALIA | 0.1% |

| MND AT | MONADELPHOUS GROUP LTD | 0.1% |

| AIA AT | AUCKLAND INTERNATIONAL AIRPORT | 0.1% |

| AMP AT | AMP LTD | 0.1% |

| HVN AT | HARVEY NORMAN HOLDINGS LTD | 0.1% |

| CSC AT | CAPSTONE COPPER CORP | 0.1% |

| AUB AT | AUB GROUP LTD | 0.1% |

| ILU AT | ILUKA RESOURCES LTD | 0.1% |

| NWH AT | NRW HOLDINGS LTD | 0.1% |

| RGN AT | REGION RE LTD | 0.1% |

| BGL AT | BELLEVUE GOLD LTD | 0.1% |

| NXG AT | NEXGEN ENERGY LTD | 0.1% |

| TLX AT | TELIX PHARMACEUTICALS LTD | 0.1% |

| LLC AT | LENDLEASE CORP LTD | 0.1% |

| ORA AT | ORORA LTD | 0.1% |

| PNI AT | PINNACLE INVESTMENT MANAGEMENT | 0.1% |

| IFL AT | INSIGNIA FINANCIAL LTD | 0.1% |

| DBI AT | DALRYMPLE BAY INFRASTRUCTURE L | 0.1% |

| RWC AT | RELIANCE WORLDWIDE CORP LTD | 0.1% |

| SUL AT | SUPER RETAIL GROUP LTD | 0.1% |

| TAH AT | TABCORP HOLDINGS LTD | 0.1% |

| CLW AT | CHARTER HALL LONG WALE REIT | 0.1% |

| DYL AT | DEEP YELLOW LTD | 0.1% |

| YAL AT | YANCOAL AUSTRALIA LTD | 0.1% |

| NHC AT | NEW HOPE CORP LTD | 0.1% |

| HDN AT | HOMECO DAILY NEEDS REIT | 0.1% |

| BWP AT | BWP PROPERTY GROUP LTD | 0.1% |

| IMD AT | IMDEX LTD | 0.1% |

| ZIP AT | ZIP CO LTD | 0.1% |

| PPT AT | PERPETUAL LTD | 0.1% |

| MSB AT | MESOBLAST LTD | 0.1% |

| NIC AT | NICKEL INDUSTRIES LTD | 0.1% |

| CQR AT | CHARTER HALL RETAIL REIT | 0.1% |

| VEA AT | VIVA ENERGY GROUP LTD | 0.1% |

| CYL AT | CATALYST METALS LTD | 0.1% |

| CNU AT | CHORUS LTD | 0.1% |

| PNR AT | PANTORO GOLD LTD | 0.1% |

| PXA AT | PEXA GROUP LTD | 0.1% |

| CIA AT | CHAMPION IRON LTD | 0.1% |

| FLT AT | FLIGHT CENTRE TRAVEL GROUP LTD | 0.1% |

| PRN AT | PERENTI LTD | 0.1% |

| DRR AT | DETERRA ROYALTIES LTD | 0.1% |

| ARB AT | ARB CORP LTD | 0.1% |

| IPX AT | IPERIONX LTD | 0.1% |

| TUA AT | TUAS LTD | 0.1% |

| OBM AT | ORA BANDA MINING LTD | 0.1% |

| CIP AT | CENTURIA INDUSTRIAL REIT | 0.1% |

| BPT AT | BEACH ENERGY LTD | 0.1% |

| INA AT | INGENIA COMMUNITIES GROUP | 0.1% |

| BGA AT | BEGA CHEESE LTD | 0.1% |

| TPG AT | TPG TELECOM LTD | 0.1% |

| HLI AT | HELIA GROUP LTD | 0.1% |

| SLX AT | SILEX SYSTEMS LTD | 0.1% |

| GQG AT | GQG PARTNERS INC | 0.1% |

| JDO AT | JUDO CAPITAL HOLDINGS LTD | 0.1% |

| GDG AT | GENERATION DEVELOPMENT GROUP L | 0.1% |

| ELD AT | ELDERS LTD | 0.1% |

| SRG AT | SRG GLOBAL LTD | 0.1% |

| NEU AT | NEUREN PHARMACEUTICALS LTD | 0.1% |

| ASB AT | AUSTAL LTD | 0.1% |

| LOV AT | LOVISA HOLDINGS LTD | 0.1% |

| WPR AT | WAYPOINT REIT LTD | 0.1% |

| MP1 AT | MEGAPORT LTD | 0.1% |

| IFT AT | INFRATIL LTD | 0.1% |

| FBU AT | FLETCHER BUILDING LTD | 0.1% |

| NCK AT | NICK SCALI LTD | 0.1% |

| NEC AT | NINE ENTERTAINMENT CO HOLDINGS | 0.1% |

| IRE AT | IRESS LTD | 0.0% |

| ARF AT | ARENA REIT | 0.0% |

| CNI AT | CENTURIA CAPITAL GROUP | 0.0% |

| GNC AT | GRAINCORP LTD | 0.0% |

| KAR AT | KAROON ENERGY LTD | 0.0% |

| MFG AT | MAGELLAN FINANCIAL GROUP LTD | 0.0% |

| DMP AT | DOMINO'S PIZZA ENTERPRISES LTD | 0.0% |

| PMV AT | PREMIER INVESTMENTS LTD | 0.0% |

| GYG AT | GUZMAN Y GOMEZ LTD | 0.0% |

| EBO AT | EBOS GROUP LTD | 0.0% |

| IEL AT | IDP EDUCATION LTD | 0.0% |

| CKF AT | COLLINS FOODS LTD | 0.0% |

| SIQ AT | SMARTGROUP CORP LTD | 0.0% |

| DTL AT | DATA#3 LTD | 0.0% |

| AOV AT | AMOTIV LTD | 0.0% |

| CQE AT | CHARTER HALL SOCIAL INFRASTRUC | 0.0% |

| WEB AT | WEBJET LTD | 0.0% |

| DGT AT | DIGICO INFRASTRUCTURE REIT | 0.0% |

| HMC AT | HMC CAPITAL LTD | 0.0% |

| SDR AT | SITEMINDER LTD | 0.0% |

| TPW AT | TEMPLE & WEBSTER GROUP LTD | 0.0% |

| XPH6 Index | SPI 200 FUTURES MAR26 | |

| AUD | AUD - AUSTRALIA DOLLAR | 0.6% |

* As at 3 March 2026.

As described in the PDS, the Fund may either invest directly and/or via an underlying exchange traded fund (ETF). The information above shows either the direct holdings of the Fund or the holdings of the underlying ETF on a look through basis which closely approximates the Fund’s percentage exposure to those investments.

Index sector exposure

| Financials | 33.1% |

|---|---|

| Materials | 24.6% |

| Industrials | 7.4% |

| Health Care | 7.1% |

| Consumer Discretionary | 7.0% |

| Real Estate | 6.5% |

| Energy | 4.0% |

| Consumer Staples | 3.4% |

| Communication Services | 3.3% |

| Other | 3.6% |

* As of 30 January 2026

Performance

Fund returns after fees (%)

| Fund | Index | |

|---|---|---|

| 1 month | 6.88% | 6.92% |

| 3 months | 11.74% | 11.86% |

| 6 months | 11.51% | 11.55% |

| 1 year | 24.34% | 24.61% |

| 3 year p.a. | - | 15.62% |

| 5 year p.a. | - | 13.48% |

| 10 year p.a. | - | 11.91% |

| Since inception | 17.36% | 17.62% |

| Inception date | 17-May-23 | - |

* As at 27 February 2026.

Past performance is not an indicator of future performance. Returns are calculated in New Zealand dollars using exit unit prices at the start and end of the specified period. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. Returns for periods longer than one year are annualised. Current performance may be higher or lower than the performance shown.

Chart

Past performance is not indicative of future performance. Please refer to "Fund returns after fees" for additional information regarding performance/return information.